The tungsten market has entered a pivotal phase, shaped by geopolitical maneuvering, resurging industrial demand, and tightening supply dynamics. Once overshadowed by more prominent critical minerals like lithium and rare earths, tungsten (“wolframite”) is now firmly in the spotlight — not only as a key industrial material but also as a strategic military metal.

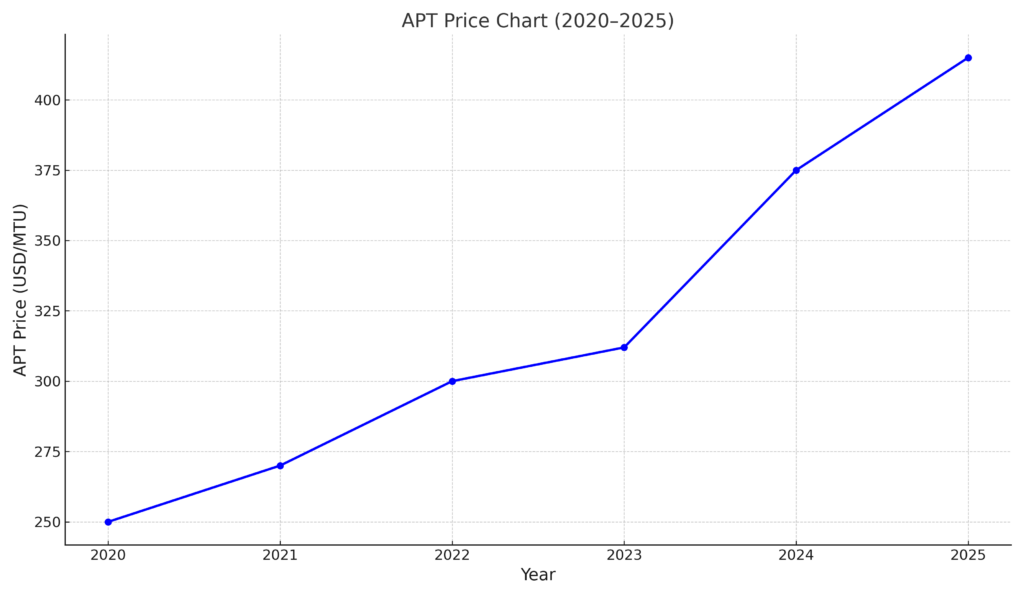

Price Landscape and Market Dynamics

As of early 2025, ammonium paratungstate (APT), the benchmark tungsten product, was trading around $415 per metric ton unit (MTU), a strong rebound from $312/MTU in 2023 and $375/MTU in 2024. Market watchers are now eyeing a possible move past $460/MTU in 2026, with some forecasts suggesting that $400–$450/MTU will become the new floor in coming years.

Historically, tungsten’s price swings have reflected global industrial health and China’s market behavior. While the market remained subdued post-2012, the past two years have seen a structural shift as military and industrial consumers ramp up restocking, especially in Europe and North America, amid concerns over supply security.

Supply and Resource Shifts

China still accounts for ~82% of primary global supply, but this dominance is under pressure. State-owned Chinese mines are facing falling ore grades, and Beijing’s dual-use export restrictions, (implemented in December 2024), aimed at the U.S. have injected new urgency into the West’s diversification efforts.

Notably, Europe has become a critical non-Chinese supplier. Spain and Portugal, thanks to projects like Panasqueira (Almonty Industries) and Barruecopardo (EQ Resources), are emerging as linchpins of non-Chinese supply. South Korea is poised to re-enter the production stage through Almonty’s Sangdong mine, which could deliver ~7% of global supply upon ramp-up in 2025–2026. Australia’s Mt. Carbine, revived by EQ Resources, and potential U.S. projects (e.g., Guardian Metal Resources’ Pilot Mountain and Tempiute mines) are also on investor radars.

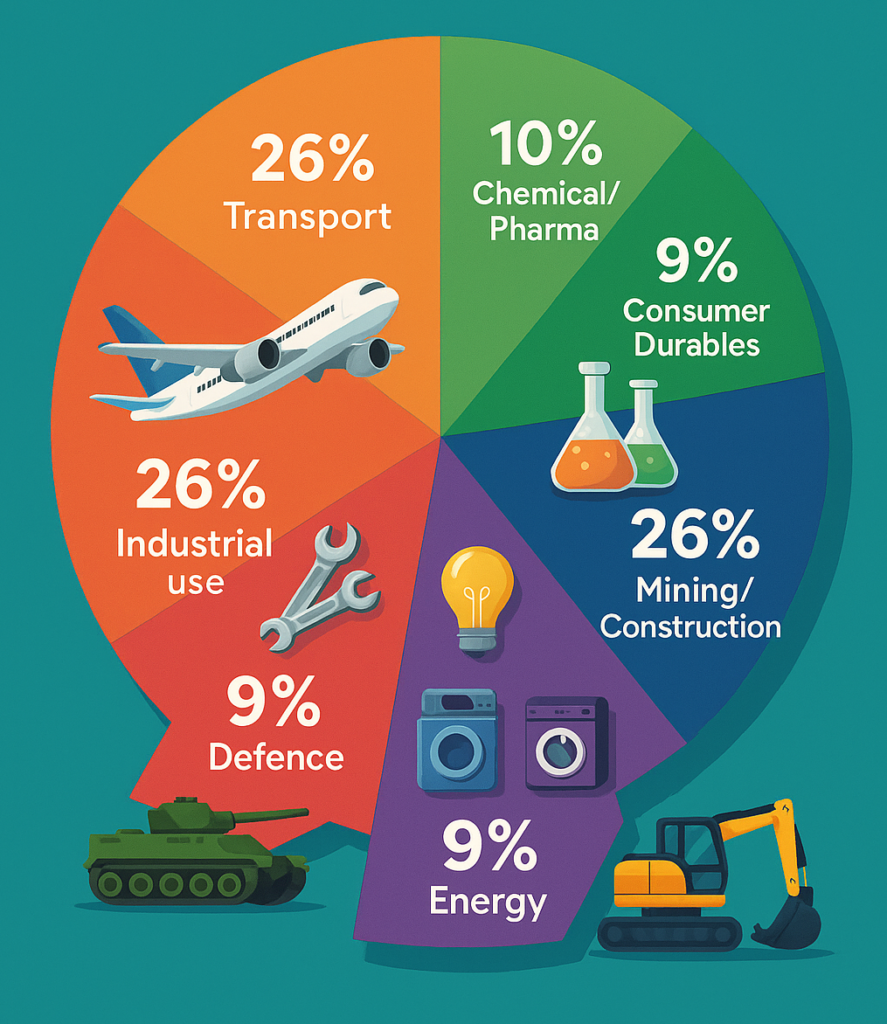

Demand Drivers: Military and Industry

Tungsten’s military relevance is unparalleled. Used in armor-piercing munitions, tank armor, and rocket components, its military applications drive a substantial portion of demand. This has become politically charged: the U.S. Department of Defense is backing new domestic sources, and Europe’s defense sector has secured long-term offtake agreements to avoid Chinese dependency.

Industrial demand, tied closely to machine tools, drilling equipment, and wear-resistant materials, remains robust. Machine-tool manufacturers in Germany, Sweden, and Japan are paying premiums to secure non-Chinese tungsten, insulating themselves from supply shocks.

Geopolitical Underpinnings

China’s December 2024 dual-use technology ban, part of the broader tech-trade conflict with the U.S., was a wake-up call. Unlike earlier measures on gallium or germanium, this move underscored tungsten’s military value. Yet, while initially rattling market sentiment, the restrictions failed to trigger a price panic. Instead, they accelerated diversification, especially as non-Chinese production rose.

The U.S. has responded with tariffs — notably a 25% tariff on Chinese tungsten imports (August 2024) — and defense funding for domestic developers. Meanwhile, Europe benefits from historical production hubs and is leveraging them to maintain supply independence.

Project Pipeline and Investment Challenges

Despite bullish pricing, the global tungsten project pipeline remains thin. The 2011–2015 price collapse shuttered many projects and scared off exploration capital. While companies like Almonty, EQ Resources, and Masan High-Tech Materials (Vietnam) are now expanding, there’s little near-term greenfield supply beyond Sangdong.

Factors limiting project acceleration include:

- Long development timelines (~5–7 years)

- High upfront capital costs

- Scarcity of high-grade (>0.6% WO₃) deposits

- Cautious financing, with few juniors able to attract capital without offtake backing

Recycling and Secondary Supply

Scrap remains a wild card. With scrap making up roughly one-third of supply in good price environments, its mobilization depends heavily on APT prices. Reports suggest substantial stockpiles in Europe and China awaiting favorable market conditions — meaning higher prices could draw more recycled tungsten into the system.

Outlook and Risks

The tungsten market is poised for structural tightness through 2030, with prices likely stabilizing at elevated levels. Key drivers include:

- Sustained military restocking

- Industrial demand growth (~1.3% CAGR through 2029)

- China’s resource depletion and political use of supply leverage

- Limited greenfield supply

However, risks continue to loom:

- A global economic slowdown could hit industrial demand

- A geopolitical thaw (e.g., China–U.S. détente) might soften strategic buying

- Excessive speculative activity could trigger price volatility

Overall, the shift from Chinese dominance to a multipolar supply landscape is underway, and for investors and end-users alike, proactive engagement with reliable, non-Chinese sources will be critical.