Global industries are undergoing a transformation, driven by the race to decarbonize, digitize, and secure the building blocks of modern technologies. At the center of this shift are critical minerals—essential raw materials like lithium, cobalt, nickel, and rare earth elements—that underpin everything from electric vehicle batteries to renewable energy technologies and semiconductor production. Against this backdrop, Friedrich Merz, leader of Germany’s Christian Democratic Union, and Mark Carney, the former Governor of the Bank of England, have pledged to deepen cooperation on securing and developing strategies around these resources. Their announcement signals the wider acknowledgment that safeguarding critical mineral supply chains has become a core geopolitical and economic priority.

Why Critical Minerals Matter

Over the past decade, critical minerals have shifted from being niche commodities to becoming strategic assets central to energy transition, industrial resilience, and, increasingly, geopolitical influence. These minerals are vital because:

- Lithium: Key for rechargeable batteries powering electric vehicles and grid storage.

- Cobalt & Nickel: Ensures energy density and stability in next-generation batteries.

- Rare Earth Elements: Core to producing magnets used in wind turbines, electronics, and defense technologies.

Demand for these resources is projected to rise sharply over the next two decades. The International Energy Agency (IEA) estimates that demand for lithium alone could increase 40-fold by 2040 if countries meet their global climate commitments. This surge presents both opportunities and vulnerabilities. The concentration of supply—often dominated by a few countries—creates risks for economies seeking energy security, industrial competitiveness, and strategic autonomy.

Merz and Carney’s Strategic Collaboration

The cooperation between Merz and Carney reflects a forward-looking approach to ensuring reliable, ethical, and sustainable access to minerals. Their commitment emphasizes three shifts in how governments and private actors must respond:

- Resilient Supply Chains: Diversifying sourcing options to reduce over-reliance on a single country or supplier.

- Sustainable Development: Promoting responsible mining practices that minimize environmental impact.

- Global Partnerships: Working across borders to establish lasting frameworks for collaboration on technology and resource management.

By advocating for transparent sourcing practices, Merz and Carney are aligning resource strategies with ESG principles (Environment, Social, Governance). Their collaboration highlights the urgent need to ensure that critical mineral development supports both economic expansion and the goals of the green transition.

A European Imperative

For Europe, securing reliable access to critical minerals is not optional—it is existential. The European Union has unveiled strategies such as the European Critical Raw Materials Act, designed to ensure the bloc achieves greater supply autonomy. Currently, the EU imports the vast majority of its raw materials, leaving it exposed to geopolitical tensions, trade restrictions, and supply disruptions in regions like Southeast Asia and Africa, where large reserves are concentrated.

Germany, as Europe’s largest economy and industrial powerhouse, faces additional pressures. Its automotive sector—the backbone of its manufacturing exports—is rapidly shifting toward electric mobility. Without secure supplies of lithium, nickel, and cobalt, the automotive transformation risks being slowed or derailed. Partnering with global allies and leaders like Carney amplifies Germany’s leverage in negotiating favorable access and developing consistent supply chains.

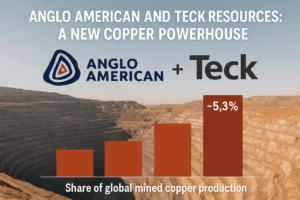

Global Dimension: Beyond Europe

The Merz-Carney partnership also fits into a broader international narrative. Nations like the United States, Canada, and Australia have all recognized the urgency of creating supply chain frameworks that are less dependent on China, a dominant supplier of many critical minerals. China currently processes up to 90% of rare earths globally, giving it significant sway over access and pricing. Allied countries are stepping up collaborations to mitigate these risks.

Carney’s track record in finance and global economic systems provides an institutional lens for ensuring that new investments are structured to attract private capital while adhering to sustainability standards. For Merz, the partnership provides an avenue for Germany to reposition itself as a leader in securing resources for Europe’s industrial future.

Sustainability at the Core

One feature that distinguishes this collaboration from past resource agreements is the focus on sustainable extraction and responsible supply management. Both leaders have emphasized that responsible mining practices are integral to any future agreements. This includes:

- Reducing carbon intensity of mining operations.

- Implementing circular economy practices, including recycling and reprocessing existing materials.

- Improving conditions and transparency in mineral-rich developing countries.

This perspective reflects a recognition that global consumers and investors are increasingly demanding environmentally and ethically sourced materials. As policies like Europe’s Green Deal drive demand for clean energy technologies, aligning supply chains with green principles will be a differentiating factor in the global market.

Economic and Geopolitical Implications

Strategic cooperation on critical minerals not only supports industrial growth but also strengthens geopolitical resilience. In an era when global tensions are rising—from trade disputes to great-power competition—supply chain vulnerabilities can quickly escalate into broad economic risks. By fostering international alliances around mineral access, countries aim to hedge against these disruptions, stabilizing both domestic industries and global energy transition goals.

For investors and markets, this deepening cooperation signals a significant opportunity. Venture capital, private equity, and institutional investors are increasingly prioritizing assets tied to critical minerals, particularly those linked to renewable energy, battery production, and grid modernization. As such, collaborations led by figures like Merz and Carney could help mobilize broader participation from the financial community into critical mineral infrastructure.

Looking Ahead: A Strategic Blueprint

The cooperation announced by Friedrich Merz and Mark Carney represents more than a bilateral understanding; it reflects the framework of a strategic blueprint for how nations and economic leaders can prepare for the mineral-intensive future. By reinforcing global cooperation, advocating for transparent and sustainable practices, and fostering new capital flows into mineral development, they are charting a pathway for countries to achieve climate ambitions while safeguarding economic resilience.

The challenges ahead are significant—ranging from environmental risks and global competition to ensuring fair trade practices in mineral-rich countries. But the opportunities, if pursued responsibly, could support decades of industrial transformation, technological innovation, and sustainable economic growth.

Key Takeaway

The Merz–Carney initiative marks a decisive step in enhancing supply security, advancing sustainability, and fortifying the architecture of the clean energy transition. By focusing on resilient supply chains and global cooperation, their partnership encapsulates the shift from viewing critical minerals as simple commodities to seeing them as indispensable enablers of the world’s low-carbon future.