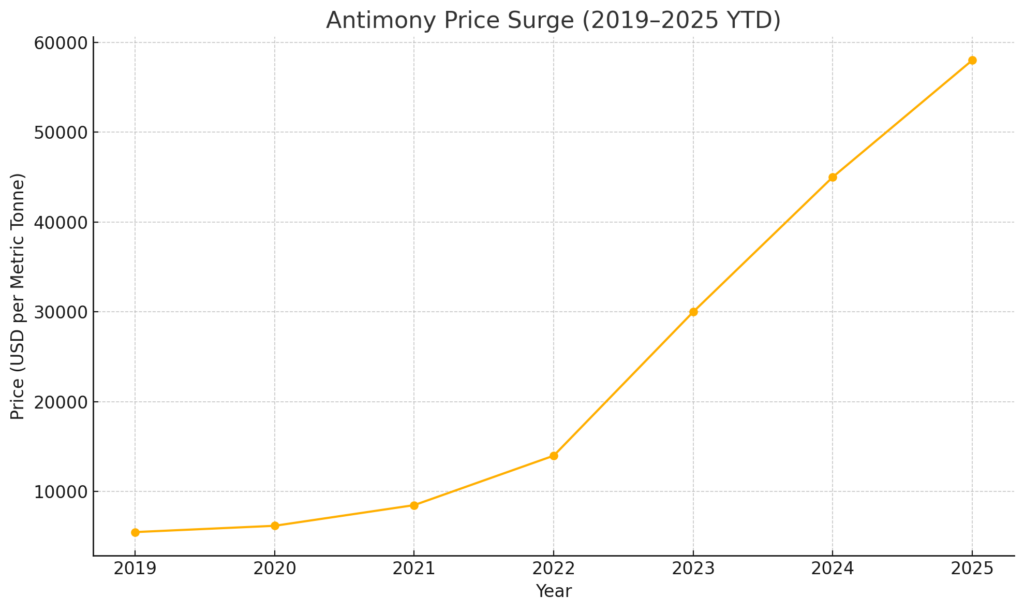

The Antimony frenzy is by now well documented, but the drama continues to unfold in real time. Prices have soared to unprecedented highs — currently trading between $57,000 and $60,000 per tonne, depending on the specific material. This meteoric rise, from just $5,500/MT a few years ago, has left traders, manufacturers, and policymakers scrambling to keep pace.

However, not all markets are feeling the same heat. In China — which dominates global Antimony production — prices remain below the $30,000/tonne mark. This price gap reflects Beijing’s strict export controls and the temporary halt in broader shipments, creating a stark two-tiered market: one for domestic use and one for the rest of the world, where demand continues to outstrip available supply.

The Demand Conundrum

Despite the eye-watering price levels, one key question keeps surfacing: how sustainable is this surge? Demand remains opaque, and as a result, many market participants are uncertain about how long these elevated prices will hold.

Shipping lead times are adding another layer of complexity. Vessels sailing from Antimony-producing hubs in Vietnam, Cambodia, Thailand, and China are now quoting around two months for delivery to Europe. This delay has European buyers understandably wary of paying today’s sky-high prices for material that might not arrive for another 60 to 90 days — especially when no one can predict whether the price will collapse or climb further by then.

To hedge this risk, a premium is being charged for prompt delivery in Rotterdam. Yet, in a sign that confidence may be waning, some suppliers with material already in Europe are even starting to sell at the benchmark price — forgoing the premium altogether — out of fear that prices could reverse sharply.

Substitution and Strategic Stockpiles

The biggest question facing the market is whether demand destruction or substitution is on the horizon. More than one buyer has admitted they’re exploring ways to reformulate products to bypass Antimony altogether. In the US, several buyers have said they’re stocked up on Antimony ingots and trioxides for now, with some floating cheeky offers as low as 70% of the benchmark price. Their rationale? They claim the Defense Logistics Agency (DLA) has met its stockpile quota — though whether that’s true remains a matter of debate.

What we do know is that the US is laser-focused on shoring up domestic critical minerals supply. With over $300 million earmarked for developing critical metals, including Antimony, the long-term goal is clear: reduce reliance on imports, especially from China, and secure a stable domestic supply chain.

Eastern Resilience and China’s Quiet Moves

Meanwhile, buyers in Korea and Japan are accepting the hefty benchmark prices without much pushback. Their steady purchasing patterns are providing some stability to the market, even as Western buyers grow more cautious.

Interestingly, while China has officially paused broad Antimony exports, it continues to ship material under special licenses — primarily to Russia, but also to Europe and elsewhere. These shipments, especially material that is exported to Europe come with the stipulation that the material must not be resold to the US, reflecting the geopolitical chess game that’s increasingly entwined with the critical minerals sector.

What’s Next?

Many market participants are cautiously optimistic that the Antimony market has stabilized — at least for now. Annual demand is estimated at around 120,000 tonnes, while actual global supply last year hovered closer to 100,000 tonnes. That 20,000-tonne shortfall underscores a fundamental truth: unless new Antimony mining projects come online soon, the market will remain tight.

There’s also the long-term question of market expansion. Beyond simply plugging the current supply gap, the industry is watching for signs of whether Antimony’s use in next-generation technologies — particularly in energy storage and advanced materials — might grow enough to drive sustained demand beyond today’s crisis-driven buying.

For now, the Antimony story remains a fascinating case study of what happens when supply squeezes, geopolitics, and market psychology collide. Whether this is the dawn of a new era for this once-overlooked metal, or just a temporary boom before a bust, remains to be seen. One thing is certain: Antimony is no longer flying under the radar.