Tin came to the fore in 2006 when lead was declared hazardous in solder and the industry turned to tin. It averaged $20,000/tonne in the years leading up to late 2020 when consumer electronics ballooned and tin prices shot up in 2021/2022 averaging $30,000/tonne during those 2 years.

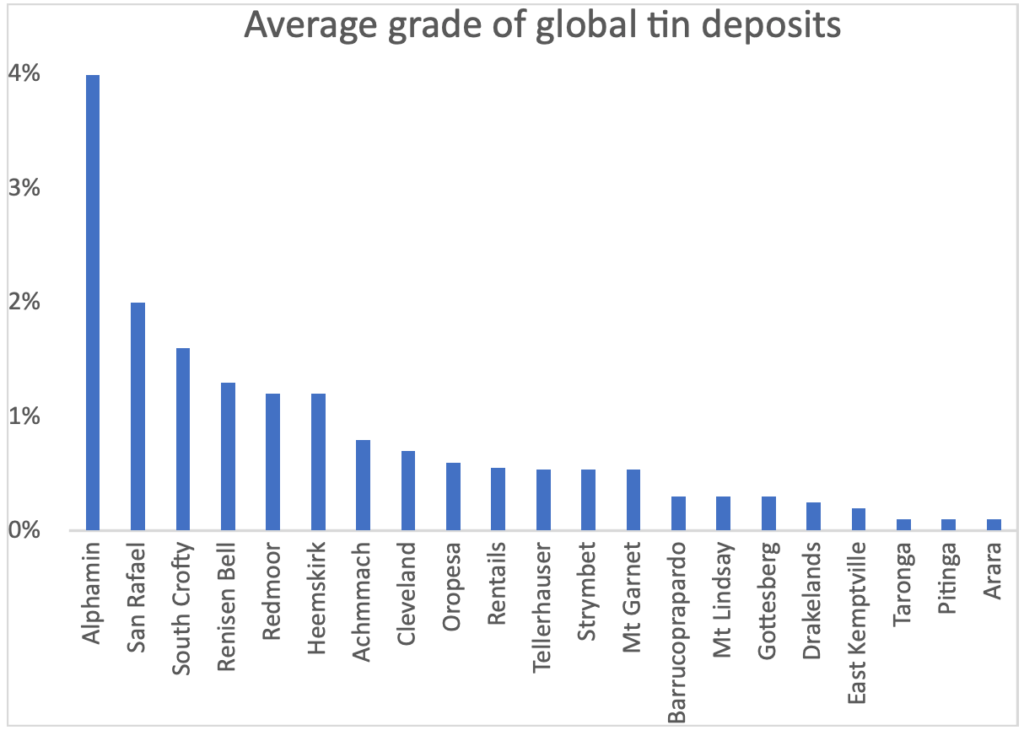

In truth, tin has always been a particularly volatile commodity, with its fortunes heavily reliant on autocratic countries with the largest producers hailing from Indonesia and Malaysia. Alphamin (TSX.V: AFM) hit commercial production in August 2019, tin prices at the time were roughly $20,000/tonne. 2020 was initially challenging with COVID and low tin prices but from 2021 onwards the Company benefited from an upswing in the tin market, allowing Alphamin to pay down its debt and generate increasing free cash flow for its shareholders. The paying down debt transformed the company into one of the world’s lowest-cost, highest-grade producers.

Source: McKinsey

The Tin Market Again in an Upswing

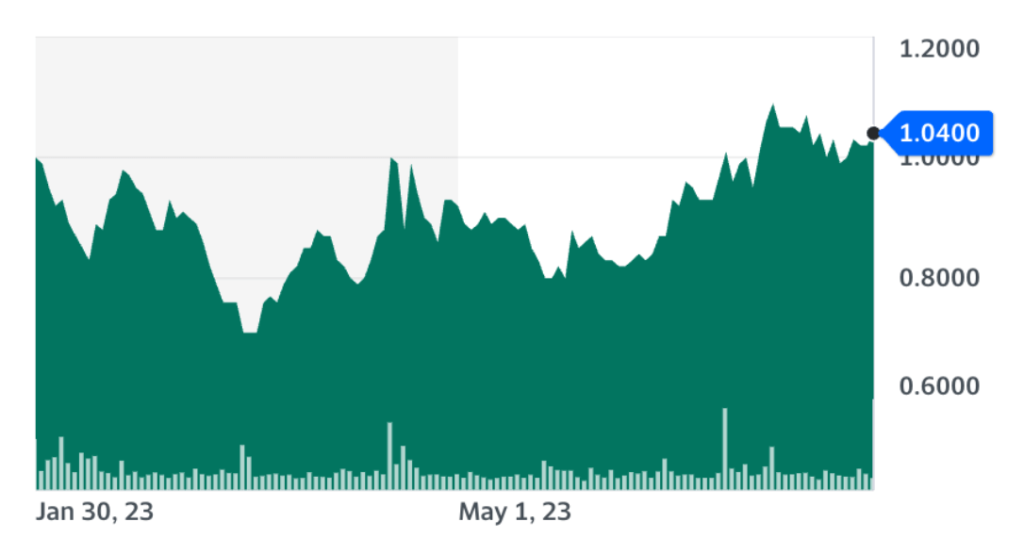

In May 2023, BMI Country Risk & Industry Research, a unit of Fitch Solutions, revised its tin price forecast for 2023 upward to $25,000/tonne from $23,000/tonne at that time. The rationale for the boost in prices was on the back of announced mine suspensions of Myanmar from August 2023, citing the need to protect remaining resources following years of mining. The suspension threatens around 10% of global tin concentrate supplies. Already the tin market has rebounded to $28,850/tonne at the end of July and Alphamin’s share price traded at over one dollar, from 80cps at the beginning of May.

Source: Yahoo Finance https://ca.finance.yahoo.com/quote/AFM.V?p=AFM.V&.tsrc=fin-srch

As of July 2023, the volumes of tin at the LME warehouses more than doubled month-on-month, with metal arriving daily in response to the squeeze in prices. Similarly, the Shanghai Futures Exchange has been rebuilding stocks since the start of 2023 with buyers trying to avoid a demand crunch and risks to the electronic sector. This has resulted in the tightness easing in the market and inventories reaching an 8-month high, with 4,305 tonnes held by LME warehouses at the end of June.

Logically one might expect that prices will start to weaken, but with the supply disruption from Myanmar looming, the market views these stocks as a much-needed “inventory cushion.”

Supply disruption looms – reliable suppliers needed

From the start of August, all tin mining will be suspended in the Wa region of Myanmar. This region accounts for 10% of the global mined tin production and is a major supplier to China’s tin smelters which represent over a quarter of the world’s tin demand. Add to this looming supply crunch several Chinese producers, including the world’s sixth-largest producer-Guangxi China Tin, will be shutting plants for scheduled maintenance. The maintenance period is expected to last a minimum of 45 days, making room for stable suppliers like Alphamin Resources to help plug the supply gap.

While global producers grapple with issues of supply, Alphamin continues to increase production. In 2Q the company processed 99,035 tonnes of tin ore, producing 3,151 tonnes of tin over the quarter. Alphamin further reiterated that the commissioning of its Mpama South is progressing well and the company is moving towards its goal of producing 20,000 tonnes by 2024, from 12,500 tonnes produced in 2022.

At steady state capacity, Mpama South will produce around 7,200 tonnes of tin-in-concentrate annually, adding to Alphamin’s Mpama North supply of 12,500 tonnes per annum. Once nameplate capacity is achieved, Alphamin will take its place as one of the largest tin producers in the world, accounting for 7% of global tin production and putting the company in a strong cash position to continue to explore for a third mine.