In Canada’s Windfall Lake, 200km north of Val D’or (Valley of Gold), three companies are positioned around the same geological faults in the most active exploration site in Quebec, the Abitibi greenstone belt. Since the early 1900’s, the area has produced over 170 Moz of gold, 400 Moz of silver, 35 billion lbs of zinc and 15 billion lbs of copper.

Gold returned just shy of 25% to investors last year as people looked to the precious metal as a low-risk investment. Social, political and economic upheaval have long been associated with positive movement in the gold market, and 2020 was a poster child for all three.

Over the last 12 months, Osisko Mining Inc (TSX-V: OSK) and Bonterra Resources Inc (TSX-V: BTR) saw negative share price movement, yet significantly outperforming the Canadian metals and mining market was relative newcomer and close neighbour Durango Resources Inc (TSX-V: DGO ; OTCQB: ATOXF ; Frankfurt: 86A1).

A Market-Beating Junior

Increased financing has been flowing into juniors to replenish the diminishing gold supply since 2019, but the recent turnaround in the spot gold price has highlighted those companies that possess untapped growth potential.

As of march 4th, the CA metals & mining market grew by +28.2% over 12-months. Over the same period, Bonterra retreated -17.3% and Osisko -12.6%, while Durango pulled ahead of the wider market to return +38.5% to its shareholders.

Share price movement in-line with the gold price reversal suggests little upside potential outside of the main gold trend, and investors might be better off buying bullion or ETFs than a company that tracks the spot trend.

Generally, gold companies see heavy investment and positive share price movement on good news. Positive drilling assays, an NI 41-101 resource estimate, PEA, PFS or FS will almost always result in climbing share values.

Osisko has already passed the PEA stage: Reporting positive drill results in July 2018, coinciding with an influx of large-scale investment and the beginning of a bull-run in its share price lasting around 12 months. Currently, Osisko trades at CA$2.87; a reasonable valuation considering the company is still delineating its albeit large resource.

Bonterra experienced similar in 2017 with the extension of its Gladiator deposit, attracting major private placements and seeing the share price almost triple before the end of the year. Bonterra’s share price sits at CA$1.10 as of March 4th, which seems justified on the basis that the company’s land package and grades are significantly smaller than Osisko’s.

Durango (TSX-V: DGO ; OTCQB: ATOXF ; Frankfurt: 86A1) is just beginning to release results from its drill targets, some just meters away from Osisko’s. The positive trend in its share price suggests that retail investors are excited by the prospect of further discovery at Windfall, and at only CA$0.09, represents the highest near-term upside potential of the three.

While Osisko and Bonterra have substantial works ahead to achieve a PFS and PEA respectively, Durango is fully permitted for the current drill program and should be steadily releasing assays in the coming months.

Should the company strike gold during the current drill program, it would prove that Durango’s Windfall project shares the same structural geology as its neighbours, almost certain to prompt strong positive movement in the share price.

A Strategic Property

Durango acquired its Windfall properties, Barry and Trove, in 2010 at bargain prices. The claims are contiguous to Osisko’s land packages, with promising gold grades and exceptional silver grades coming from Osisko drill holes.

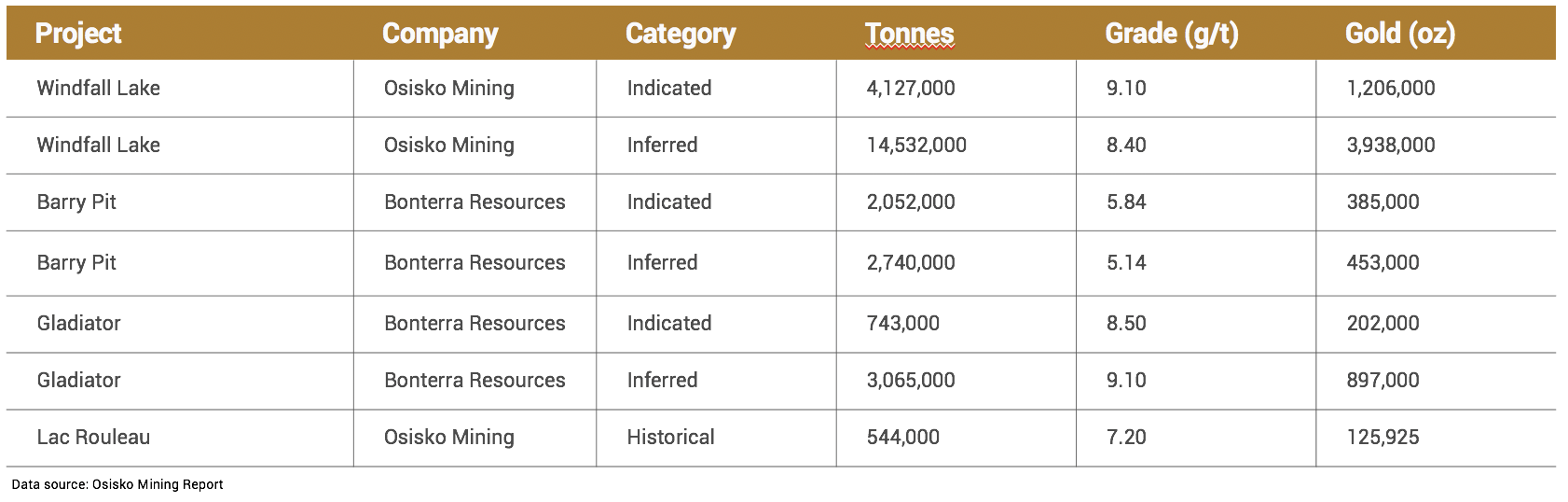

Resource estimates from neighbouring claims range from medium-to-high grade, with Osisko looking at in-ground reserves in the millions of ounces. The Gladiator and Windfall Lake deposits, in particular, show particular promise as potential high-grade mines.

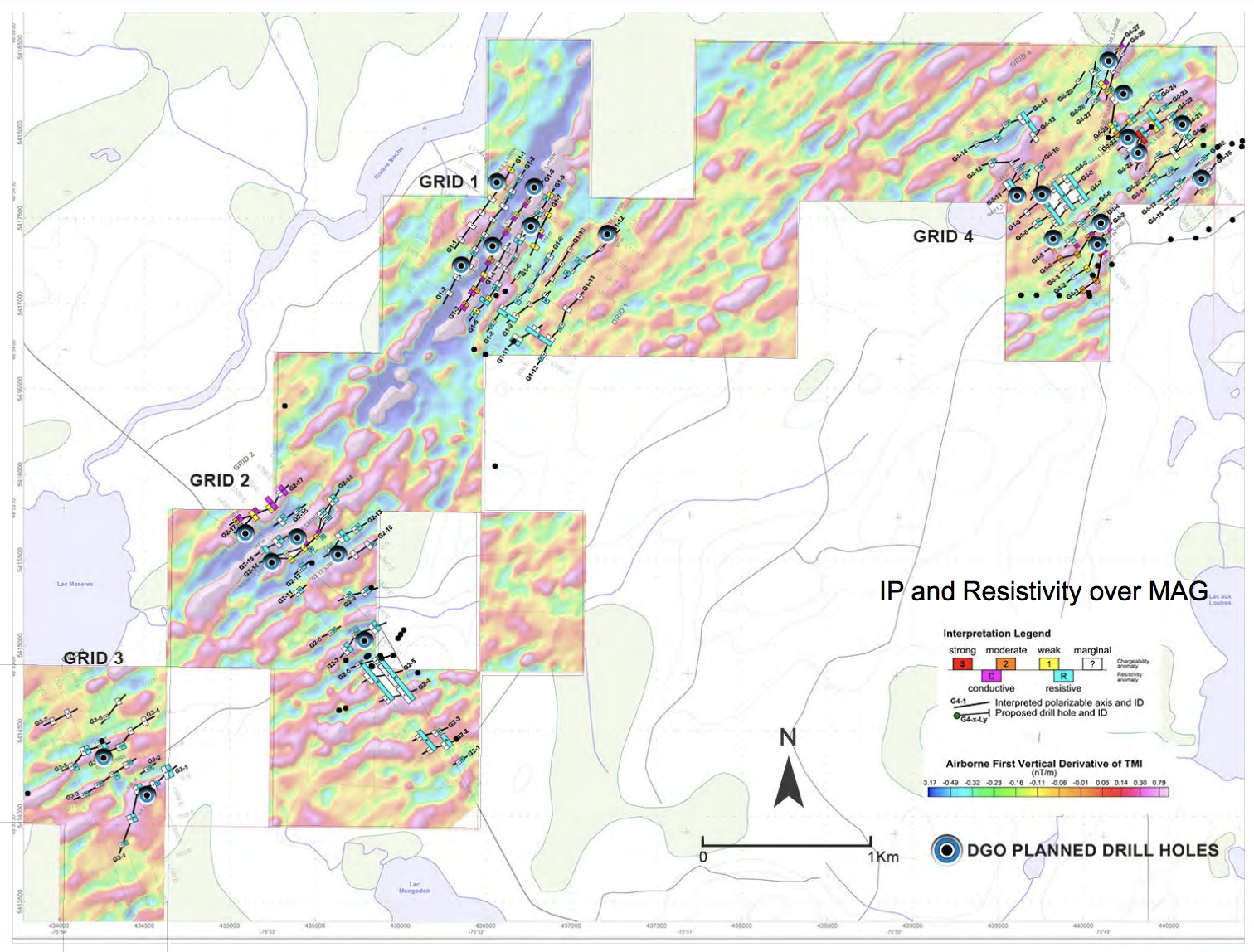

Induced polarization and magnetic resistivity surveys have revealed a significant number of priority targets running through Durango’s claims, demonstrating that the same northeast trending shear zones running through neighbouring projects permeate the property and do indeed contain conductive materials.

This was further demonstrated by recent preliminary drill assays that contained upwards of 15g/t silver and 1.5% zinc. At the time of writing, more than 2,800 assays are still being processed by various laboratories, which include Durango’s highest-priority targets.

Earlier exploration work by Durango revealed rusty till, pristine gold grains and multiple quartz-bearing structures protruding from the surface; encouraging signals that strongly justify continued exploration, especially considering that pristine gold has typically travelled less than 100m from source.

The recent discovery of native silver on the Trove Property is an indication that the current drilling may be near the top of a hydrothermal system which is why we are now drilling deeper to reach an area where higher gold content may be expected. The native silver is very encouraging as it may suggest we are one step closer to a new gold discovery at Windfall Lake. ~Marcy Kiesman, CEO Durango Resources

A Confident Team

Confidence is high amongst the management team at Durango. The company is positioned on geological features already proven to contain mineralization by nearby operations. The team’s outlook is borne out by completed geophysical models of the properties and a high degree of insider ownership.

Durango’s management team holds 15.2% of the company’s shares with no selling activity, suggestive of a long-term mindset as opposed to short-term profit-seeking. Conversely, while insider trading volume is high, Osisko’s team have sold more shares than they have bought over the past year.

Durango is financially healthy, is debt-free and has no long-term liabilities; the personal risks taken by insiders holding fast to long positions belies a sense of belief among management. Bonterra, on the other hand, has some debt and its current short-term assets are insufficient to cover its long-term liabilities. While Osisko is financially healthy, frequent insider selling does little to inspire confidence.

The management team at Durango have a combined 150 years of experience. The company’s CPA, CMA, CEO & Director, Marcy Kiesman, has spent more than 15 years in public mining company management, and the technical Committee Chair, Dale Ginn (30+ years experience), led the discovery teams for the Gladiator, Hinge, 007, 777, Trout Lake, and Tartan Lake deposits.

Closing Remarks

The Abitibi greenstone belt has a long history of profitable mine production; the Windfall Lake area in particular has been extensively delineated in recent years. Of the three main players vying for gold at Windfall, Durango Resources represents the highest near-term upside potential considering the company’s as-yet undefined resource and relatively late stage neighbours.

The company’s early results have demonstrated mineralization on the property, and positive share price movement is expected should this be borne out further by pending assay results.

Interested in learning more about Durango Resources, click here.