Idaho Copper (OTC: COPR) is advancing one of the largest untapped copper projects in the United States. Still, questions about investing in copper persist in a multipolar and chaotic world and an even more unpredictable market.

We all know that copper should feature prominently in any forward-looking investment portfolio. However, many potential investors still grapple with three important questions:

- When to invest?

- Where to invest?

- Will demand for copper remain sustainable in the long run?

There is no better time to invest than right now. Prices are weaker than earlier this year and with geopolitical tension rising once again, getting a foot in the door as soon as possible will pay substantial dividends in the future.

Although fears about political stability make it hard to pick a preferred mining jurisdiction right now, traditional investment-friendly and politically stable mining environments like the USA, Canada, and Australia, are better picks compared to developing countries that are more exposed to the vagaries of the market, internal socio-political battles, and the risks of macroeconomics.

Keeping in mind that analysts predict a significant copper supply deficit within the next decade due to a dearth of new projects across the world, an advanced exploration project like Idaho Copper’s copper, silver, and molybdenum development, deserves a closer look.

Idaho Copper looks to fast-track development

Idaho Copper’s project in the south of Idaho in the USA has a massive copper asset with substantial upside, backed up by significant co-products molybdenum and silver.

With its management team looking to fast-track development, Idaho Copper should be able to add its significant resource base to the current global inventory of viable copper mines within the next decade.

The fundamentals for copper and other critical metals remain strong, and demand will continue to be driven by the energy transition.

Copper prices have dropped more than 4% this year to about $8,000 a tonne, down from more than $10,000 at their peak last year, in the wake of a cooling world economy and as production at new mines in Peru and Chile ramps up.

Nevertheless, pundits remain optimistic that demand for copper will multiply in response to the growing green economy, as well as to support the economic rise of India and other developing nations.

Continued development in the electric vehicle and battery storage sectors, and massive investments in new renewable energy projects worldwide, will stimulate demand for critical minerals well into the future. At the same time, the copper supply picture appears bleak towards the end of this decade, with many existing mines nearing the end of their lives, others reducing copper production as they approach terminal grades and the lack of sufficient existing new projects in the pipeline.

A resurgence in resource nationalism in several copper-rich African and South American nations, and the rising cost of capital, have rekindled investor interest in more predictable and stable mining jurisdictions like the US and Canada. Although large copper deposits exist in South America, Africa, and Asia, many of these resources have been sterilized through short-sighted government action, regulatory uncertainty, and political instability.

The rapidly changing geopolitical landscape and rising commodity prices have placed advanced copper exploration projects in the USA like CuMo squarely on the map again.

Recent world events have prompted investors to identify high-value assets in low-risk jurisdictions that will drive the move toward green energy.

A lack of new copper projects

Speaking at the Financial Times’s recent Mining Summit in London, several of the world’s largest copper producers again warned that there is a lack of mines under development to deliver enough of the metal to keep pace with the clean energy transition.

The Mining Summit, now in its fourth year of sparking engaging conversation about the future of mining, took place at a time when most miners around the world are struggling with soft metal prices on the back of a weak global economy and cost inflation, a shortage of skills and reluctance of funders to finance new projects.

Kathleen Quirk, President of Freeport-McMoran, the largest US copper producer, said at the Summit that higher copper prices are not the only factor that will secure enough metal needed for the world to go green. “It’s not only about the price but many other factors also limit our ability to increase supply, which may result in the energy transition taking even longer to gain momentum,” she said.

Robert Friedland, CEO and President of global giant Ivanhoe Mines said that copper producers are not bringing new projects online fast enough as it becomes increasingly difficult to find new orebodies and high-quality copper in the ground.

In response to these constraints, even majors like Freeport-McMoran are turning to new technology to extract copper caught up in old mining dumps and waste material in addition to expanding existing mining operations.

According to an article in the Financial Times, Farid Dadashev, head of European metals and mining at RBC Capital Markets, said at the Mining Summit that executives were proving reluctant to invest in mines that will take 10-15 years to build and cost billions of dollars with low prices and political uncertainty in mining jurisdictions.

According to Duncan Wanblad, CEO of Anglo American, one of the world’s largest mining companies, the living standards of the average Westerner require 200-250 kilograms of copper per person, versus 60kg on average globally.

S&P Global states in a report that copper is used in everything from electrical wiring and household appliances to infrastructure such as trains. “Its use will become ever greater as the world goes green, resulting in it being dubbed the “metal of electrification”, with forecasts that it will double to a 50mn tonne market by 2035 compared with 2021 levels. S&P Global predicts a “chronic gap” between supply and demand.

Gold miners turn to copper

Even the world’s biggest gold miners are betting on copper to kickstart the green revolution. Mark Bristow, CEO of Barrick Gold Corporation, the second-largest gold mining company in the world, recently said that copper was the most strategic metal in the world. “As gold is the most precious metal, copper is the most strategic of all metals,” said Bristow in an interview with CNBC.

It’s no secret that Bristow has been on the hunt for significant copper deposits to add to Barrick’s impressive gold portfolio. Earlier this year, the company attempted a friendly takeover of Canadian-based copper producer First Quantum but was rebuffed. Nonetheless, Bristow has not given up on diversifying Barrick’s portfolio and increasing its current copper output.

Bristow said that the fundamentals for copper are solid and that there are strong indications that the market will be in short supply “very, very soon”. “All signs point to a better copper price in the future. Mining is a long-term game, and you cannot manage your business based on short-term events,” said Bristow.

Bristow’s hunger for copper is no surprise as the world moves away from burning oil, gas, and coal to power the global economy. Critical minerals are needed in increasingly large amounts to make the implementation of renewable energy solutions possible.

Invest in critical minerals to reduce climate change impact

According to the International Energy Agency (IEA), the types of mineral resources used vary by technology. Lithium, nickel, cobalt, manganese, and graphite are crucial to battery performance, longevity, and energy density.

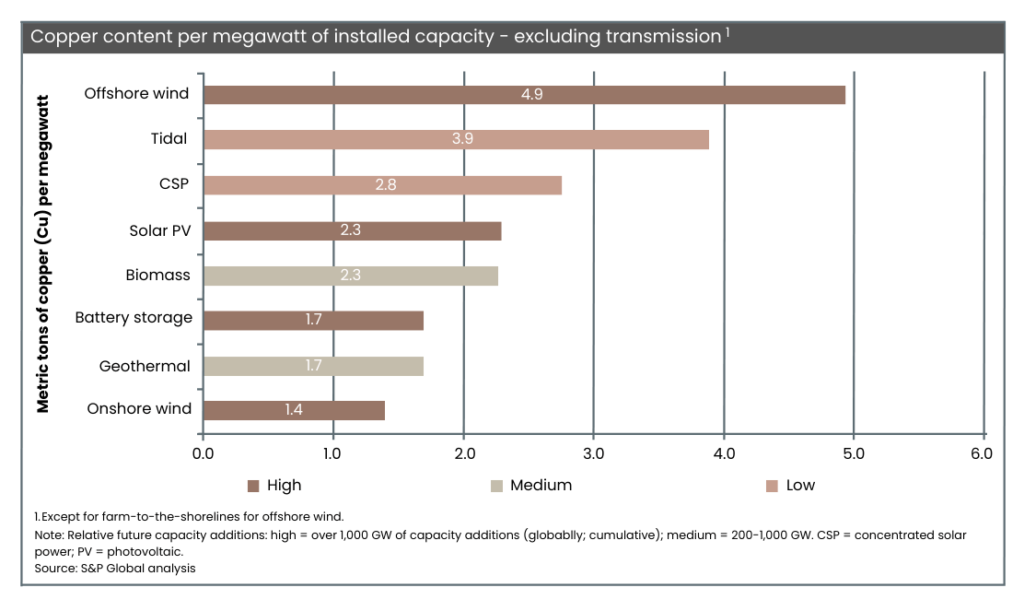

Rare earth elements are essential for permanent magnets that are vital for wind turbines and EV motors. Electricity networks need a huge amount of copper and aluminum, with copper being a cornerstone for all electricity-related technologies.

“The shift to a clean energy system is set to drive a huge increase in the requirements for these minerals, meaning that the energy sector is emerging as a major force in mineral markets. Until the mid-2010s, for most minerals, the energy sector represented a small part of total demand. However, as energy transitions gather pace, clean energy technologies are becoming the fastest-growing segment of demand,” states the IEA.

In a scenario that meets the Paris Agreement goals (as in the IEA Sustainable Development Scenario [SDS]), their share of total demand rises significantly over the next two decades to over 40% for copper and rare earth elements, 60-70% for nickel and cobalt, and almost 90% for lithium. EVs and battery storage have already displaced consumer electronics to become the largest consumer of lithium and are set to take over from stainless steel as the largest end-user of nickel by 2040.

The science is clear: to avoid the worst impacts of climate change, emissions need to be reduced by almost half by 2030 and reach net zero by 2050.

To achieve this, we need to end our reliance on fossil fuels and invest in alternative sources of energy that are clean, accessible, affordable, sustainable, and reliable. To produce viable renewable energy projects the world will need a lot of copper and other strategic and critical minerals. This puts budding new copper exploration projects like Idaho Copper’s CuMo Project in the USA increasingly in the spotlight.