Canadian-based Prime Mining Corp’s Los Reyes gold and silver project in Mexico boasts exceptional geology which has enabled the company to de-risk as the Covid-19 pandemic surges for a second time.

Prime Mining (TSX.V:PRYM) (OTCQB: PRMNF) (Frankfurt:A2PRDW) is well positioned to benefit from the worlds’ macro-economic quagmire. Returning to the traditional safe haven amidst global turmoil, conservative investors have pushed the gold price through the $1,700 per ounce roof and right up to levels where most gold projects starts looking attractive. When the world’s markets are volatile and yellow metal heads north, it is not such a bad idea to invest in decent geology and a solid gold orebody. The two factors that no money can buy, or that no unexpected crisis can suppress, are: exceptional geology and exemplary mineral endowments, of which Mexico has bucket loads.

A small number of exploration companies have been the big winners of gold’s resurgence on the back of fears about a “second wave” of Covid-19 infections. Although funding has all but dried up, those companies that have been able to secure the necessary financial backing to continue their exploration programmes, despite the health crisis, have built a stable foundation for future growth. Prime Mining has been one of them, receiving a windfall of almost $10 million recently, which they will put to good use in trenching and drilling out a further resource at Los Reyes, the company’s’ flagship project in Mexico.

Los Reyes de-risks with great geology

Exploration is a risky business at the best of times. Therefore, great geology in a well-known mining jurisdiction gives investors peace of mind, and de-risks an intrepid venture substantially. Excellent geology is the primary reason why many of today’s successful multinational mining companies were able to flourish after historic crises events in the past. Prime Mining’s Los Reyes is in a prolific region of the Sierra Madre Occidental Province, which has been mined for centuries and continues to produce operations of significant global value. Besides, as any geologist worth his or her salt would attest, the best place to look for gold is where it has already been found.

The Sierra Madre Occidental Province is known as the backbone of Mexico and hosts mineral deposits that includes the Cerro de Mercado magnetite deposit in the city of Durango, and the gold-silver mines of the San Dimas district around Tayoltita, Durango.

The Province is close to 300km wide and lies at an elevation of about 2,000m. It has been the locus of extensive exploration for gold-silver deposits. However, the rugged topography and consequent difficulty in access have limited prospecting and impeded development of the mineral resources of the region. Although the mineral riches at Los Reyes has been known for centuries, previous efforts to determine and extract its real value have been unsuccessful. Vista Gold bought Los Reyes from Vancouver-based junior Northern Crown Mining in 2009 and offloaded it to Prime Mining in 2019.

Northern Crown Mining embarked on a 10,000m reverse-circulation (RC) drill programme with the aim of defining 1.5-million ounces of heap-leachable gold in the late 1990s. An ambitious target in a remote location at a time when the gold price was testing record lows. Nonetheless, they knew there was something to work with. Gold-silver mineralization in the region was first discovered in late 1700s and between 1872 and 1938, the Guadalupe de Los Reyes mine produced 260,000 oz. gold and 15 million oz. silver from 900,000 tonnes averaging 8.8 grams gold and 521 grams silver per tonne.

According to statements by Northern Crown mining at the time, Los Reyes was an extensive underground, narrow-vein operation, as revealed by detailed 1935 underground maps. “The maps indicate a number of veins which were worked over a strike length of 2.5km and to a depth of 350-400m,” it says in the statement. Geologists coined the term “spaghetti mining” to describe the mining pattern.

Northern Crown’s target, however, was not the high-grade quartz veins, which occur along the footwall contact, but the low-grade envelope extending above the footwall. “The hanging wall holds the potential to contain significant bulk-tonnage material susceptible to open-pit, heap-leach processing. The high-grade veins will act only as sweeteners,” they stated.

An exceptional opportunity with immense blue-sky potential

When Vista Gold acquired and consolidated Los Reyes in 2009, their plan was to focus on examining the potential for expansion of the bulk mineable resource estimates already identified, and the high grade potential of the underground mineable vein systems in the district and in the lower zones of the historic mine operations. The company commenced a systematic metallurgical testing program so that the economic potential of the deposit could be evaluated.

According to a statement by Vista released in 2009, the style of mineralization at Los Reyes is similar to that of Primero Mining’s Tayoltita operation which is about 60km southeast of Los Reyes. Tayoltita boasts an impressive historical production of more than 9 million ounces of gold and 600 million ounces of silver.

When Prime Mining took over Los Reyes in 2019, the then CEO Andrew Bowering said that Los Reyes provided an exceptional opportunity for exploration and that its development would be fast-tracked through a Preliminary Economic Assessment (PEA). “A construction decision would be based on low capital expenditure and reduced technical risks. Prime Mining will work to complete the Feasibility Study while continuing to drill in order to expand existing data as well as identify promising new targets,” Bowering said. Bowering was recently appointed Executive Vice-President while Daniel Kunz, the former CEO of Ivanhoe Mines, has taken over as CEO.

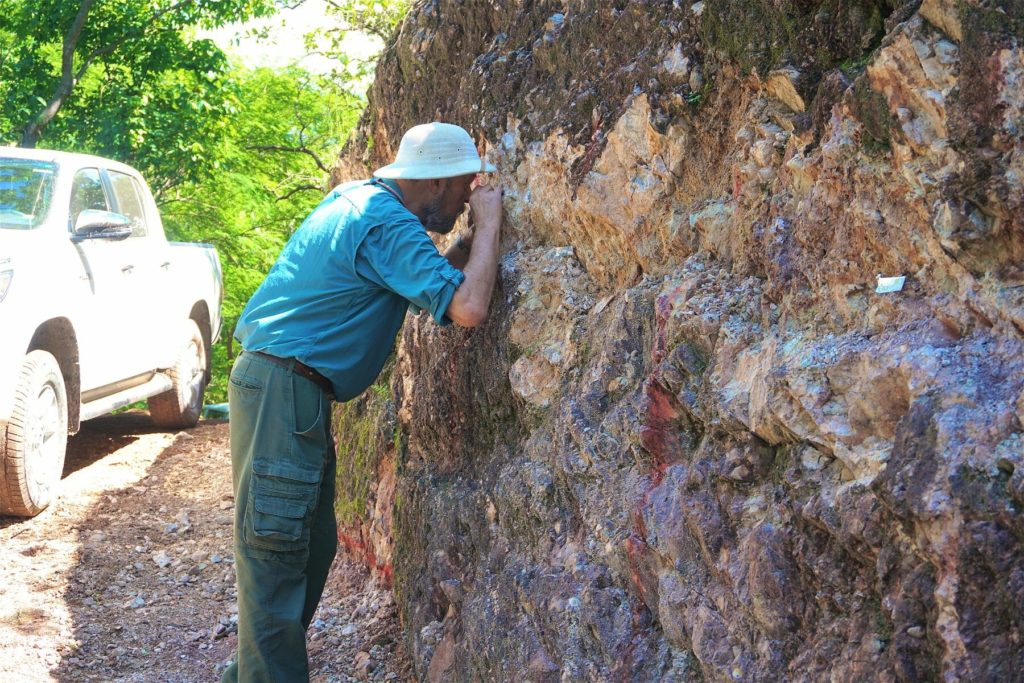

Image: Prime’s geologist exploring the area at Los Reyes’ site

A metal province with vast geological potential

Los Reyes is in one of the most solid, prolific, geological regions of the world. The property is situated west of the Sierra Madre Occidental axis, which is both a mountain range and a Tertiary-age geologic province. The Sierra Madre range hosts the largest volcanic-hosted epithermal precious metal province in the world and its vast geological potential is expected to yield significant new gold finds in the future.

Results from Prime Mining’s new trenches and road cuts in the company’s surface exploration program continue to show wide mineralized areas over the Guadalupe West deposit. Guadalupe West is one of eight deposits that occur in the project area, and sampling shows a wide exposure of mineralization at surface that extends along strike for more than 200m. The deposit was modelled using historic drilling along with some new trenching and road cut sample data and a pit constrained resource has been estimated. The sampling program has provided valuable information in determining the surface expression of mineralized structures, planning pit locations, and establishing where structures remain open to expansion.

The company has begun a systematic Phase 1 5,000m trenching and road cut sampling program on outcropping mineralized structures. Over the many years of exploration at Los Reyes, with thousands of metres of drilling and ongoing geological and engineering studies, no company has ever conducted systematic surface trenching across outcropping mineralization. Prime’s trenching and existing drill road sampling program is designed to provide valuable surface assay data to be used in conjunction with down dip drill data for their planned updated resource estimation.

Large deposit not 100% explored

After releasing its first exploration results last year, Bowering said that the Los Reyes deposit was larger than initially predicted. To date, the company has explored only 40% of the deposit and has a measured and indicated resource of 833,000 AuEq ounces, and a further 277,000 AuEq ounces. Half of the $10-million investment will be deployed into exploring the remaining 60% of the deposit in the hope that they can prove a resource of at least double this amount.

Should Prime Mining be successful in showing that this is a 2 million or even a 3 million-ounce deposit, this would put the company in the league of major gold mining companies. The Los Reyes project shows substantial resource upside, based on open extensions of known resources, 10km of undrilled strike length and at least eight exploration targets. This increases the chances that the deposit is substantially larger than what was initially anticipated. According to Bowering, the all-in-sustaining-cost is around $900/oz. Thus, at a gold price of $1,724/oz, this project seems highly attractive compared to its peers in other parts of the world which may exhibit higher grades, but with deeper gold deposits.

Prime Mining went hunting in the right area at the right time. Los Reyes boasts exceptional, basic geology and a gold deposit that is simple and easy to mine, and not technically complicated to extract. In short, the company has the benefit of a known resource and the backing of a buoyant gold price, threatening $1,900 levels in a world turned on its head by a global pandemic; and therefore, has massive upside potential. It is in times like these that gold really shines and investing in a gold-silver exploration project in Mexico, might just be the best way to hedge your bets in an extremely constrained global economy and volatile world.

Prime’s executives have managed to get funding which is testament to their network, skill, and the potential that Los Reyes exhibits. It says a lot for a junior mine to be able to advance their project towards a feasibility study in a sector which is basically seeing financing for exploration evaporating. The best way to view this asset, is that it is a known oxide deposit, amenable to low cost mining at well below the current gold price with the potential to increase its resources estimate, backed up by exceptional geology in an amenable mining jurisdiction.