Alphamin prepares for surge in tin demand

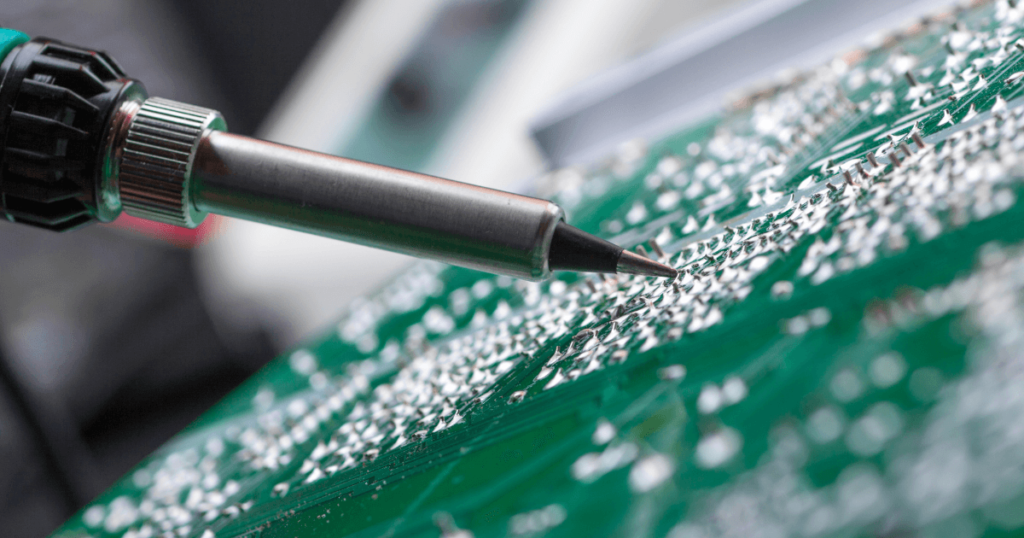

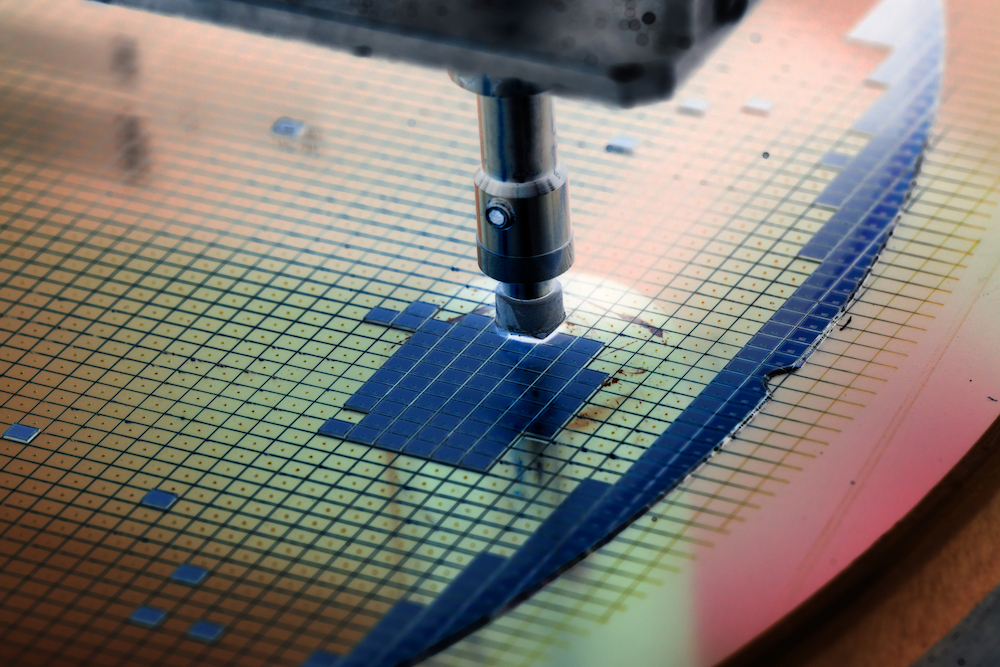

With the energy transition set to kickstart the lethargic global economy next year, tin producer Alphamin Resources Corp’s (AFM:TSXV, APH:JSE AltX) will be more than happy to deal with an expected increase in demand for tin products over the next five years.

Alphamin Resources (TSX.V: AFM) bullish on outlook

Unmoved by current macroeconomics and with an expected deficit in the tin market looming over the next five years, Alphamin Resources Corp. (AFM: TSXV, APH:JSE Altx) is on course to develop its second mine at the Bisie Hill Complex in the Democratic Republic of the Congo (DRC).

Alphamin’s super grades overshoot global norms

Alphamin Resources’ (AFM: TSXV, APH:JSE AltX) high grade tin at Bisie continues to be a matchwinner amidst a revival of low-grade brownfield projects around the world.

Alphamin’s consistency pays dividends

Alphamin Resources’ (AFM: TSXV, APH: JSE AltX) decision to expand its Bisie complex in the DRC in a bid to create further value for its shareholders, rather than to dispose of what is today one of the top tin mines in the world, bodes well for the future of this prolific deposit.

Alphamin’s Mpama South expected to produce by 2023

The imminent development of Alphamin Resources’ (AFM: TSXV, APH: JSE Alt) Mpama South deposit in the DRC is expected to add more spice to a growing success story.

Global disruption and uncertainties create need for solid supply chain partners

Strategizing solid partnerships is key to growing your business during volatile times. South African Pelagic Resources’ strength in this area sets it up to be a strong global player.

One miners’ loss is another miners’ gain

Alphamin Resources Corps’ (AFM: TSXV, APH:JSE Alt) tin mine in the DRC is on the cusp of becoming the top tin mine in the world amid global concerns about supply chains, severe headwinds for other tin producers and on the back of an ever-increasing supply and demand gap.

Alphamin on a clear growth path

Alphamin Resources Corps’ (AFM: TSXV, APH: JSE) tin mine in the Democratic Republic of the Congo (DRC) is a spectacular high-risk-high-reward growth story and with development at Mpama South imminent, the company is ready to start the next chapter in its short but astounding history.

China market action benefits DRC mining

China’s commitment to investing in overseas resources, its relatively impotent attempts to control the market, and the consequences of the pandemic era have conspired to bring the DRC into focus, where copper and tin are most abundant. Miners operating in the country include Glencore PLC (LSX:GLEN), Metorex Ltd (JSX:MTX) and Alphamin Resources Corp. (TSX:AFM), the company industrializing the world’s richest tin deposit.

Can tin hit $50k?

Tin prices are at all-time-highs and rising, and while additional production is inevitable at current levels, there is a distinct lack of new tin mines currently in development. Ongoing supply disruptions and emerging inhibitory factors continue to support the positive price trend, and as it creeps towards $50k/t, it falls to existing cassiterite mines such […]