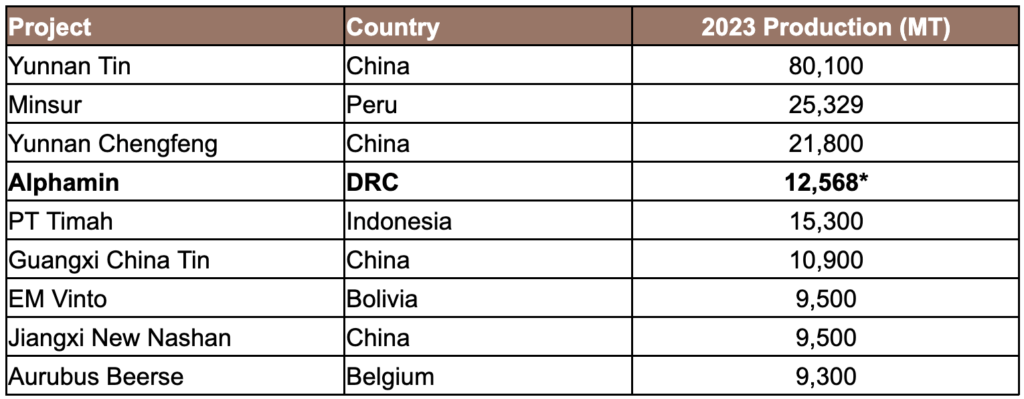

Source: Tin Association 2023 – * Expected approximately 20,000 tonnes due to commissioning of Mpama South

Supply disruptions from Indonesia and Myanmar

Indonesia, a major player in global tin exports, faces significant regulatory hurdles. Delays in approving annual mine work plans led to a near cessation of tin exports in February, disrupting global supply chains. This emphasizes Indonesia’s role as a major tin exporter and its susceptibility to regulatory interventions. While such interruptions are not unprecedented in Indonesia, the current impasse has heightened market concerns due to its duration and potential impact on global tin supply.

Meanwhile, Myanmar’s Wa State, contributing 70% of the country’s tin output, presents another layer of complexity. Despite a partial resumption of mining activities, uncertainties linger, posing ongoing supply risks. This region’s significance as a major supplier to China underscores its impact on the global tin market. The recent ban on mining activities in Myanmar’s Wa State has created ripples in the global tin market, with stakeholders closely monitoring developments for potential disruptions.

Alphamin has consistently produced over 12,000 tons since 2022 and is expected to expand its production by 50% from April 2024. To this end, Alphamin offers supply stability.

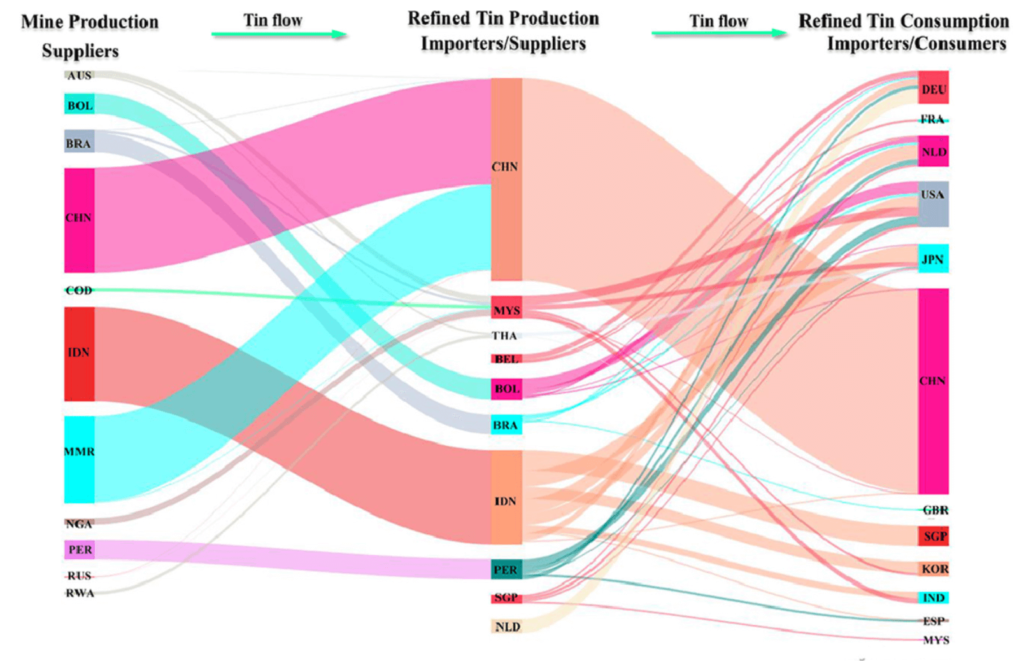

Source: Science Direct, 2021, Tracing the Global Tin Flow Network

Evolving market conditions from surplus to deficit

The tin market is renowned for its extreme price volatility, characterized by significant fluctuations in supply shortages and surpluses. Recent projections indicate a notable transition from a surplus of 6,000 tons in 2023, to a deficit of 5,000 tons expected in 2024. This shift from surplus to deficit highlights the tin market’s vulnerability to supply disruptions and evolving demand, underscoring the necessity for proactive strategies by industry stakeholders.

Semiconductors and technology as key demand drivers

Tin finds robust support from rising sales in the semiconductor and technology sectors, driven by advancements in artificial intelligence and automotive chips. As these industries experience heightened global demand, tin’s role in circuit-board soldering becomes increasingly indispensable. The growing demand for high-tech products, coupled with the expansion of the electronics industry, bodes well for the future of tin consumption, providing a silver lining amidst supply challenges.

Tin market outlook showcases resilience amid challenges

Despite supply disruptions, the tin market demonstrates resilience, with the ability to absorb near-term impacts. However, concerns linger regarding the duration of these supply disruptions in key producing regions, raising questions about long-term market sustainability. The ability of the tin market to weather short-term disruptions, while maintaining price stability, reflects its robustness and adaptability to changing market conditions.

Recent price rebounds, fueled by supply threats and positive demand indicators, highlight the market’s sensitivity to evolving conditions. Speculative interest in tin futures emphasizes investor sentiment, reflecting peaks reminiscent of previous speculative surges. While short-term price fluctuations may occur due to speculative activities, the underlying fundamentals of the tin market remain strong, driven by robust demand and constrained supply.

Navigating the future of the tin market

As stakeholders navigate the complexities of the tin market, vigilance is key. The delicate balance of supply threats and demand shifts highlights the tin market’s resilience in adversity. However, the long-term sustainability of the tin market hinges on resolving supply disruptions and fostering stability in key producing regions. To this end, the market requires more companies like Alphamin Resources, whose low-cost base and strong balance sheet allow it to weather any tin price downturns, while its geological attributes, including high grade and increasing reserves, enable the company to keep supply levels constant.

Unfortunately, there aren’t any other Alphamins. The company’s Bisie project is a true anomaly, boasting the highest grades in the world at more than 4 times higher than most operating tin producers. Furthermore, Alphamin took 6 years from resource drilling to production and unlock value, so in terms of tin exposure, from both an investment- and a supply perspective, Alphamin (TSXV: AFM) stands unparalleled.

In conclusion, the tin market is at a critical juncture, characterized by supply threats amidst a positive demand outlook. As the market charts its course through uncertain waters, stakeholders must remain adaptable and proactive in responding to emerging trends and regulatory developments. With resilience as its cornerstone, the tin market holds promise for a vibrant and evolving future, driving growth and innovation in the global economy.