Alphamin’s Bisie complex: Shaping the future of tin

Ongoing exploration at the Bisie complex in the Democratic Republic of the Congo (DRC) positions Alphamin Resources as a linchpin in the future of the tin sector. Recent exploration has uncovered substantial tin deposits, challenging the perception that tin had lost its appeal. As the boundaries between the virtual and human worlds blur, tin serves as a connecting thread in Artificial Intelligence (AI), the Internet of Things (IoT), renewable energy, and robotics.

The strategic significance of Bisie in a shifting global landscape

With China currently dominating the tin market, geopolitical risks prompt countries and multinational companies to diversify their supply chains. Africa, rich in natural resources, becomes a focal point, with Alphamin’s Bisie tin mine at the forefront. A stable supply of critical minerals like tin is crucial for technological development, green initiatives, climate change mitigation, and military defense.

The Bisie project currently produces 4% of the world’s tin (12,500 tons per annum), making it the second-largest tin producer outside of China. This market share is expected to increase to 7% as the company is expected to expand production by 50% by April 2024.

Mpama South: A geological anomaly shaping the future

Bisie’s Mpama North orebody, boasting grades of 4.5%, is a geological anomaly that has excited geologists. This high grade is a rarity in the last decade, positioning Alphamin as a key player in the industry. Mpama South is next door and is the second highest grade deposit globally, next only to Mpama North. The development of Mpama South is set to expand production, ensuring a steady future supply of tin critical for emerging technologies.

The growth of Alphamin’s operations needs to be understood in the context of global tin suppliers. The top four tin-producing countries, including China, Indonesia, Myanmar, and Peru, account for 73% of global tin production and are struggling not only to grow but to even maintain their output.

In the case of China, the country has experienced flat tin output for the last decade. Indonesia has been the swing producer, often restricting the sale of its ore, and Myanmar’s high-grade surface material is nearly depleted. Peru has had to commission tailing retreatment plants to restore its declining production profile to levels from ten years ago. Against this backdrop of rising tin demand and declining supply, Alphamin‘s role is of utmost global importance.

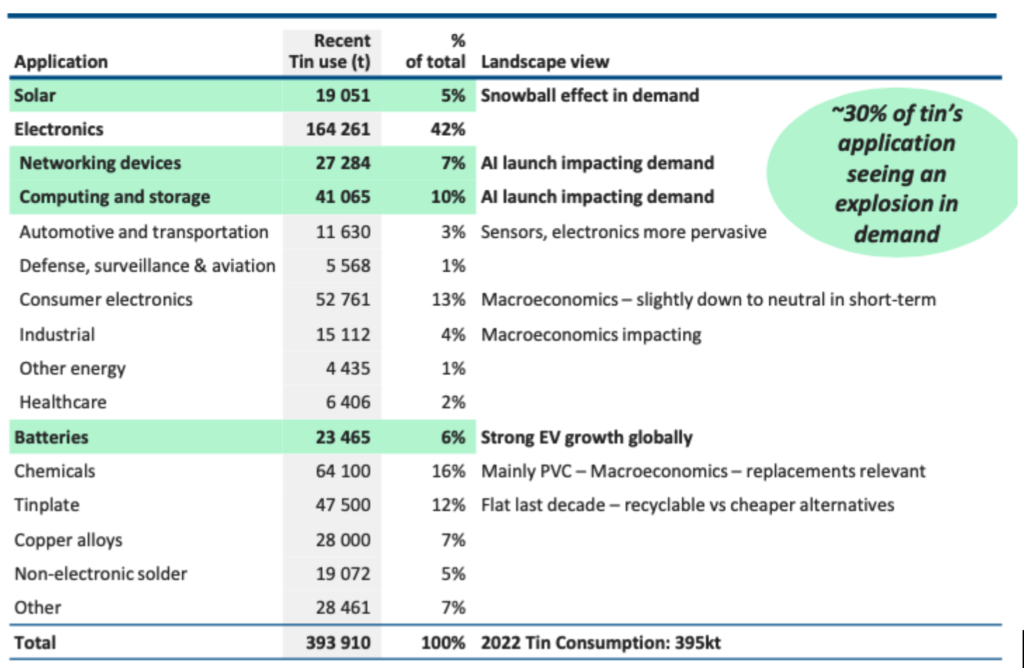

Table 1: Tin demand outlook

Source 1: Batteries: ITA 2022 report tin consumption breakdown, BNEF Transportation Forecast, ITA lead acid battery report, and MassBenchmarking reports by Don Malen. Electronics: BCC Printed Circuit Boards Technologies and Global Markets, Technavio Semiconductor Market Forecast (2) Camanoe Associates calculations (MIT team members)

The Tin-AI nexus: Navigating the tech wave

Tin’s significance in AI and robotics takes center stage as the world witnesses progress at Mpama South. In AI, tin plays a crucial role in GPUs, the backbone of machine learning and deep learning. The demand for GPUs is growing rapidly, with tin finding applications in solder and protective coatings, accelerating the development of cutting-edge technologies.

Triumphs in 2024: Challenges and surges

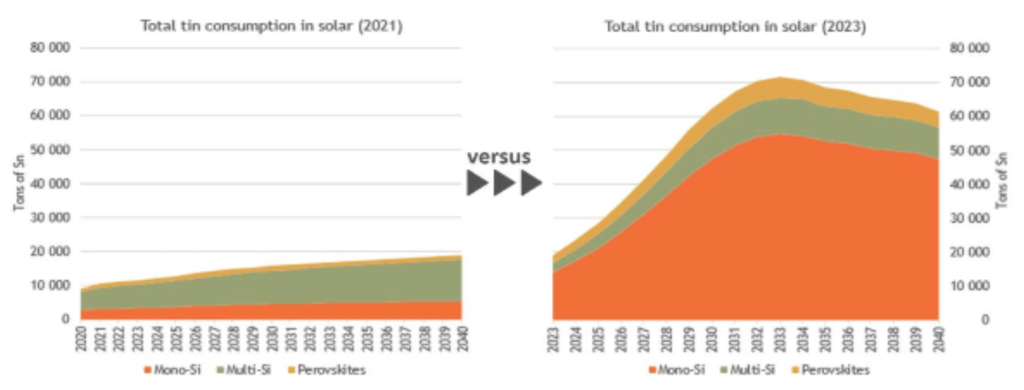

Looking ahead to 2024, global demand for tin is expected to grow, driven by semiconductors and soldering applications, which account for over 40% of tin use. Other applications, like solar, are also expected to drive significant demand, with 2023 solar capacity estimated at 322-380GW from 286GW in 2022. This increase in solar capacity requires an additional 6,000 MT of tin, equivalent to a new (large) tin mine.

Chart 1: Step-change in solar forecasts vs 2021: Driving significant tin consumption growth

Source 2: Camanoe Associates calculations 2023 and BNEF solar roll-out forecast

Alphamin’s strategic positioning is reflected in its production numbers, with 2023 year-end results anticipated to show an impressive 12,568 tonnes. Despite positive trends, challenges such as declining prices, economic slowdowns, and geopolitical factors, pose inherent risks to the tin market.

Fitch Solutions’ positive forecast and Alphamin’s role

Fitch Solutions forecasts a positive trajectory for tin prices in 2023, reaching $25,700 per tonne. Alphamin surpassed Fitch’s forecasts by achieving an average price of $26,009/tonne for the year. As global semiconductor sales recover, the demand for tin is set to increase, further solidifying Alphamin’s pivotal role in the industry.

Conclusion: Alphamin’s journey amidst Tin’s renaissance

In the complex tapestry of the tin industry, Alphamin (TSXV: AFM) stands as a beacon, navigating challenges and leveraging opportunities. The positive outlook for tin in 2024 aligns with its indispensable role in advanced technologies and the ongoing energy transition. As the world invests in tin, it simultaneously invests in a future where this unassuming yet vital metal catalyzes technological innovation, renewable energy, and interconnectedness. The dynamic nature of the tin industry demands resilience, proactive strategies, and a commitment to sustainable growth, echoing Alphamin‘s journey through the ever-changing global dynamics.