Once known only to investors familiar with the fast-expanding global telecom industry, today Huawei is a household name. US and Chinese tensions flared in 2018 shining the spotlight on the Chinese company. Why did Huawei become the symbol of the breakdown of the global trading system? And more than that, how did this telecom company become the symbol for the remarkable rise of China?

Who is Huawei and why did they become a central figure in these trade tensions?

Huawei is a tech giant who, only twenty years ago, began setting up offices in Europe and taking market share in the West. Today, Huawei has over $123bn in sales and is known for its competitive pricing. The company got its start in the mid 90’s when it built a series of telecommunication networks both in China and abroad. Today it is a leading information and communications technology (ICT) provider and has focused its efforts around the provision of telecommunication networks, IT, smart devices and cloud services. Most critically, Huawei has the lion share of the provision of 5G infrastructure, which sparked global concern that the company’s dominance in 5G will give the Chinese company and China itself, a backdoor into communications systems globally.

In a world of wireless communication, virtual reality, cyber security, and big-data, the fight for dominance is both real and imperative. The company or the country that emerges victorious could foreseeably control the very fabric that will drive modern society forward.

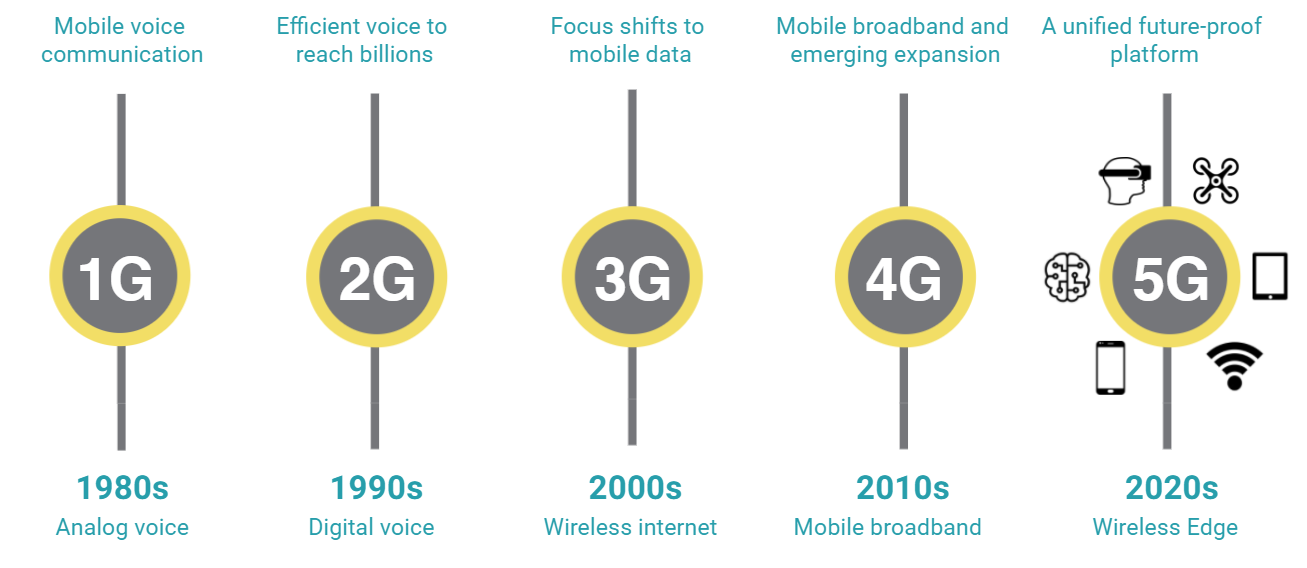

Importantly to understand is that 5G is not merely an improvement in 4G like 3G was to 2G. 5G is the NEXT MAJOR EVOLUTION of mobile communication technology

Huawei’s reach aka “China’s reach”

Irrespective of how one defines having 5G market share, whether it by subscriber, the number of smart phone devices, or by telecom equipment, Huawei, and China by extension, come out tops (or near the top) every single time. This is best illustrated by showing some data.

[visualizer id=”13662″]

Source: Strategy Analytics, 2020

[visualizer id=”13596″]

Source: SP Global

[visualizer id=”13665″]

Source: Future Market Insights, 2018

How big is the 5G story?

According to McKinsey Research, with 5G, the number of connected devices is expected to increase from 400 million in 2015 to over 5 billion by 2025.

[visualizer id=”13658″]

Source: McKinsey, February 2019

5G is the key for realising the Fourth Industrial Revolution and connected devices and bid data is expected to drive everything from 3G printing to autonomous vehicles. According to PWC, the impact from 5G technology will be enormous. PWC estimates that the widespread deployment of 5G communications will enable unprecedented levels of connectivity, super fast broadband and ultra low latency communication, and is expected to result in $13.2 trillion in global economic value by 2035.

And who controls the metals that are used in 5G technology?

Four scarce and critical metals (plus one speciality metal) make up the suite of metals employed in 5G networks. These are tabulated below:

[visualizer id=”13667″]

Source: Statista

China dominates the mining and/or supply processing of all five metals making a mockery of the goal of “independence from China” in 5G communications.

The West can reject Chinese kit and ban Huawei, but cannot replicate the Chinese equipment itself without the metal inputs that the Chinese have a stranglehold on.

The good news is that all of these metals are in fact available outside of China, but if the goal is independence, then the mining of these metals needs to be ramped up quickly. Prolonged periods of underinvestment by Western companies in producing these metals have left Western telecom firms and governments vulnerable. Investors would do well to etch these five metals into their memory and take note of what could be the next commodity wave.